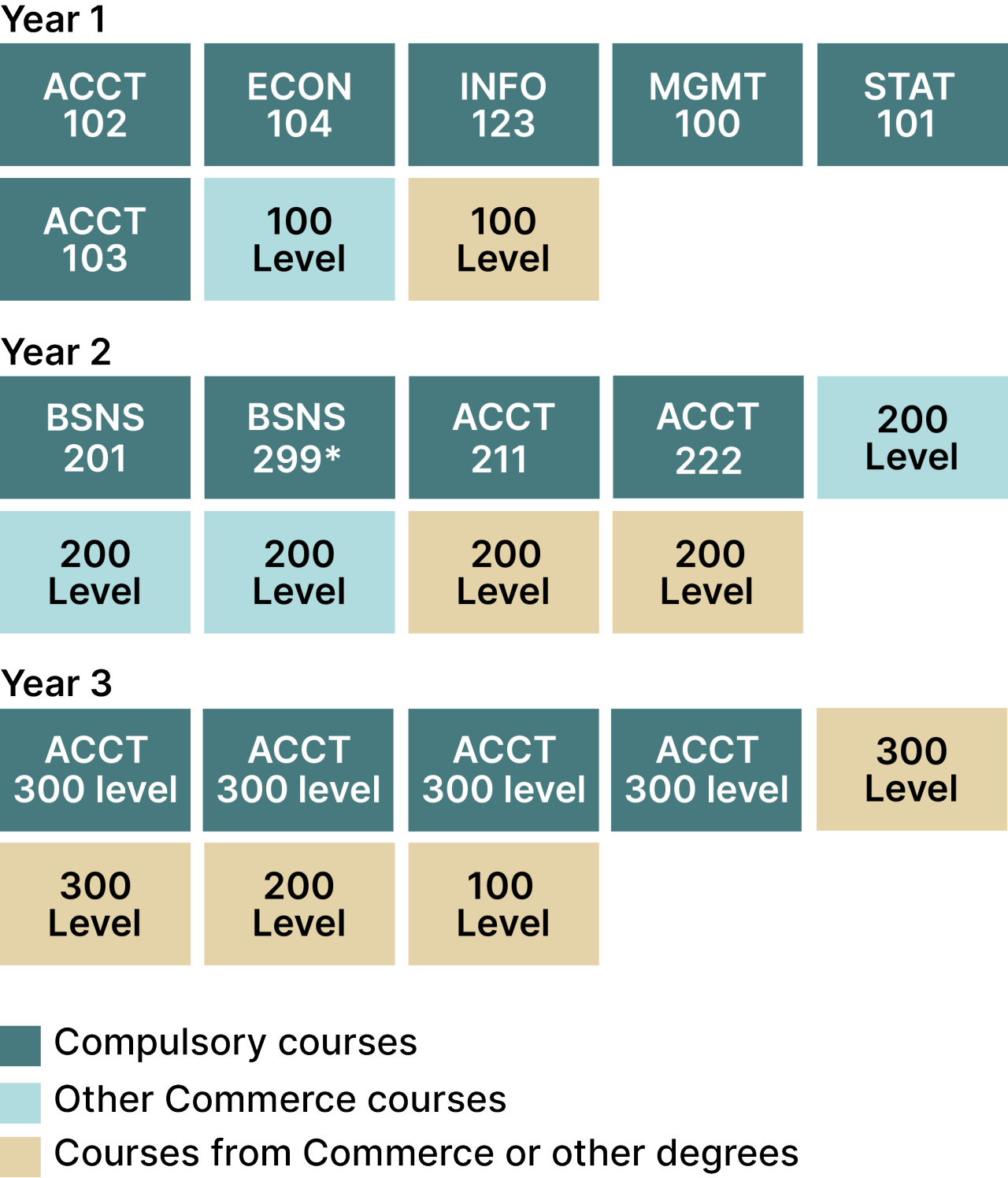

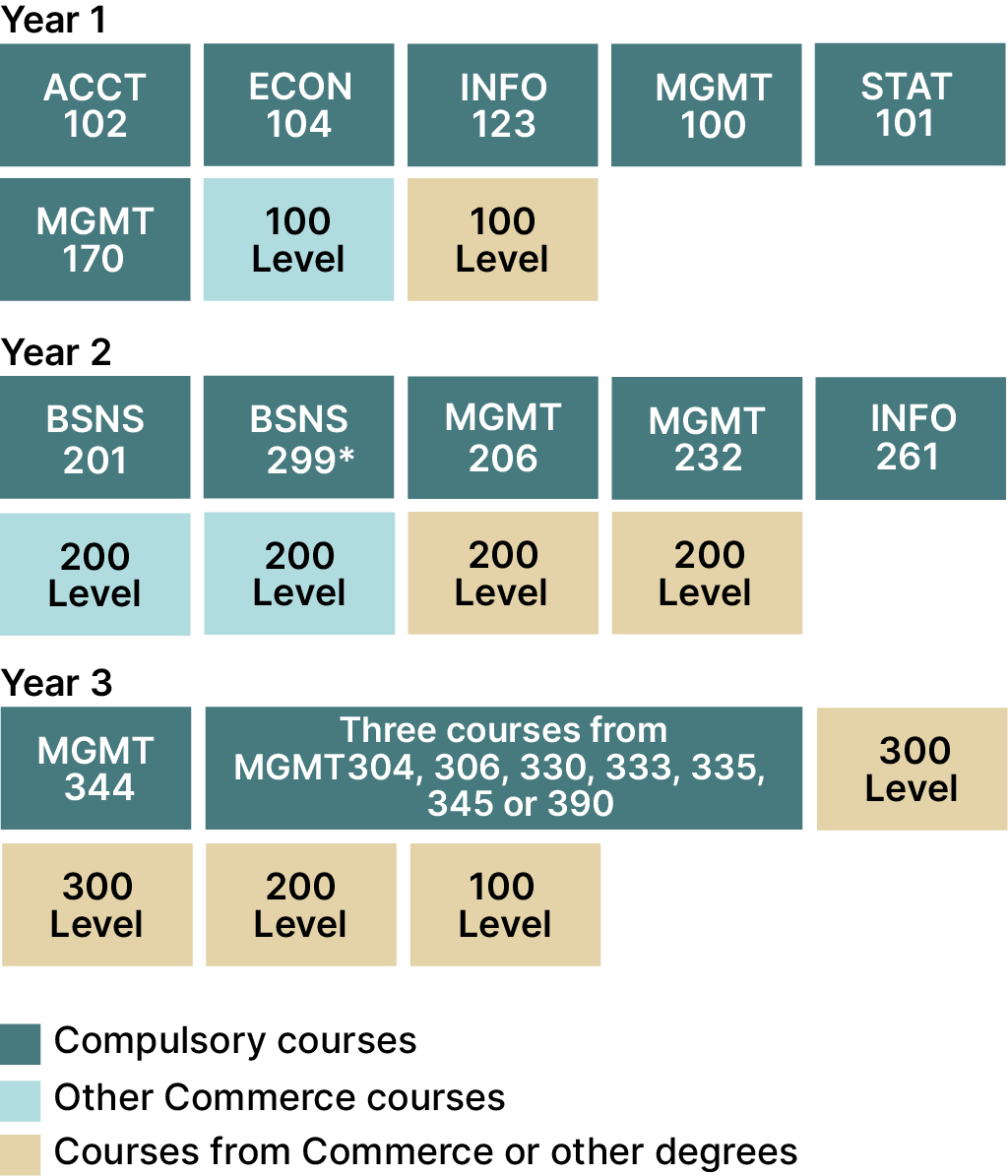

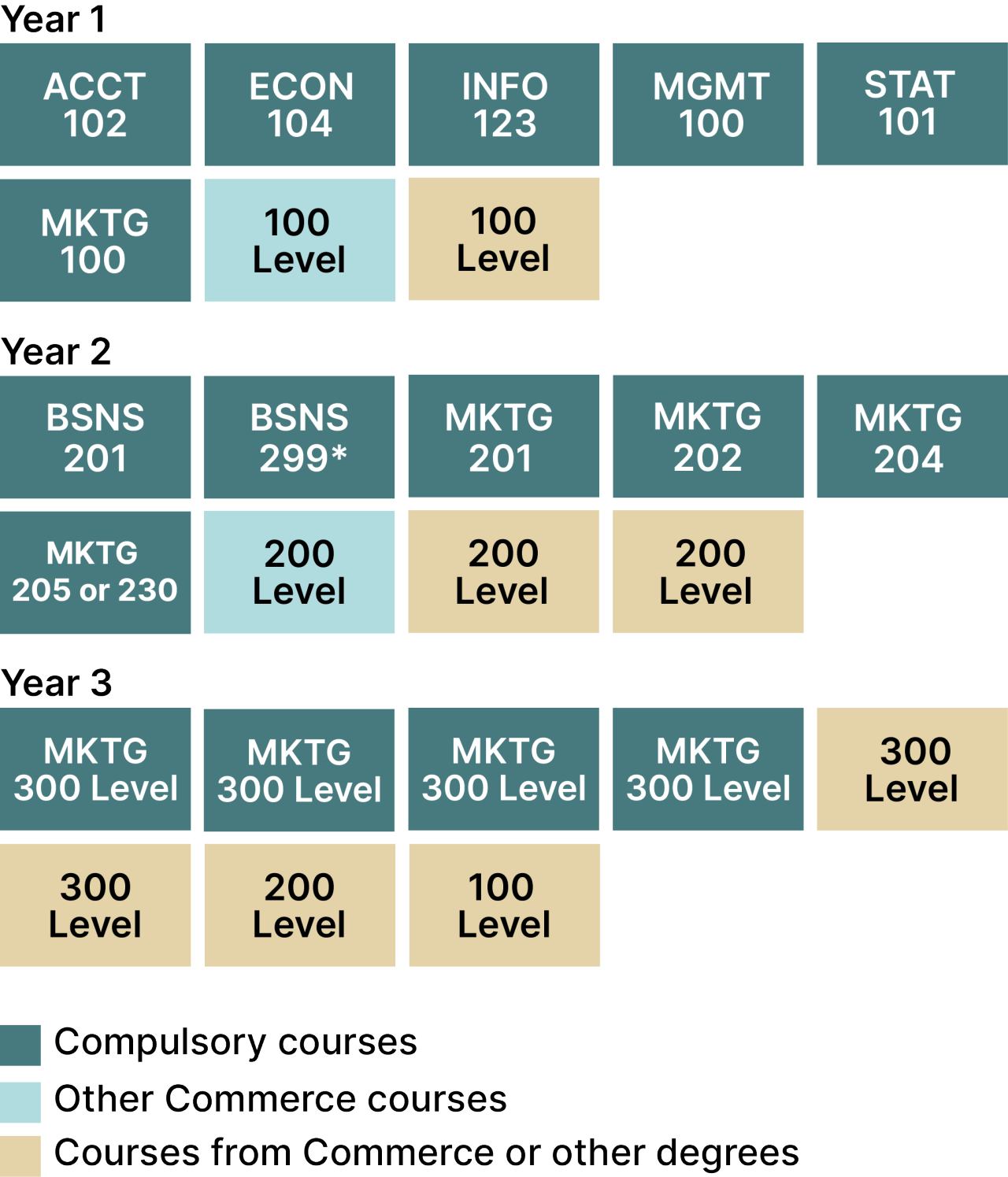

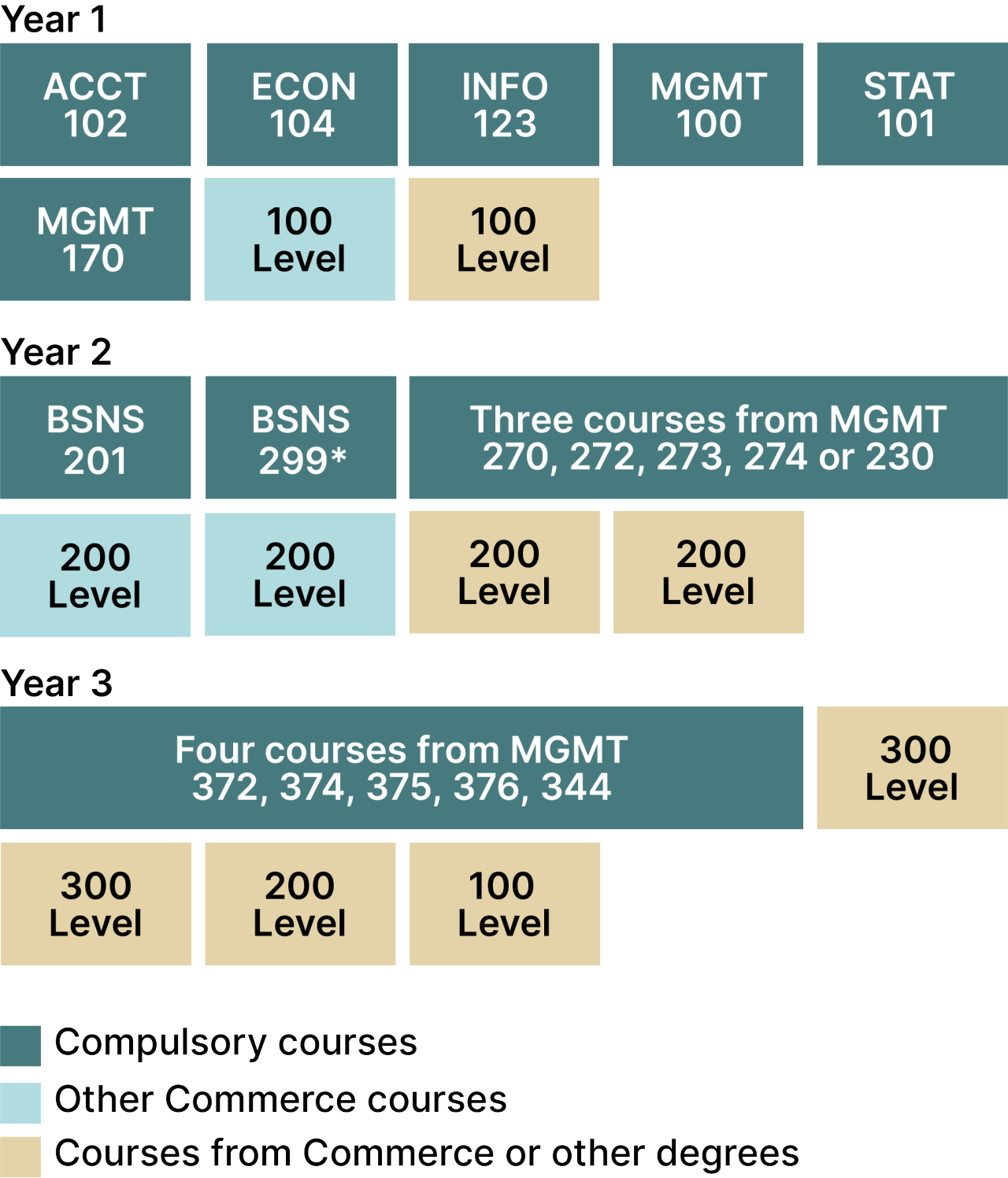

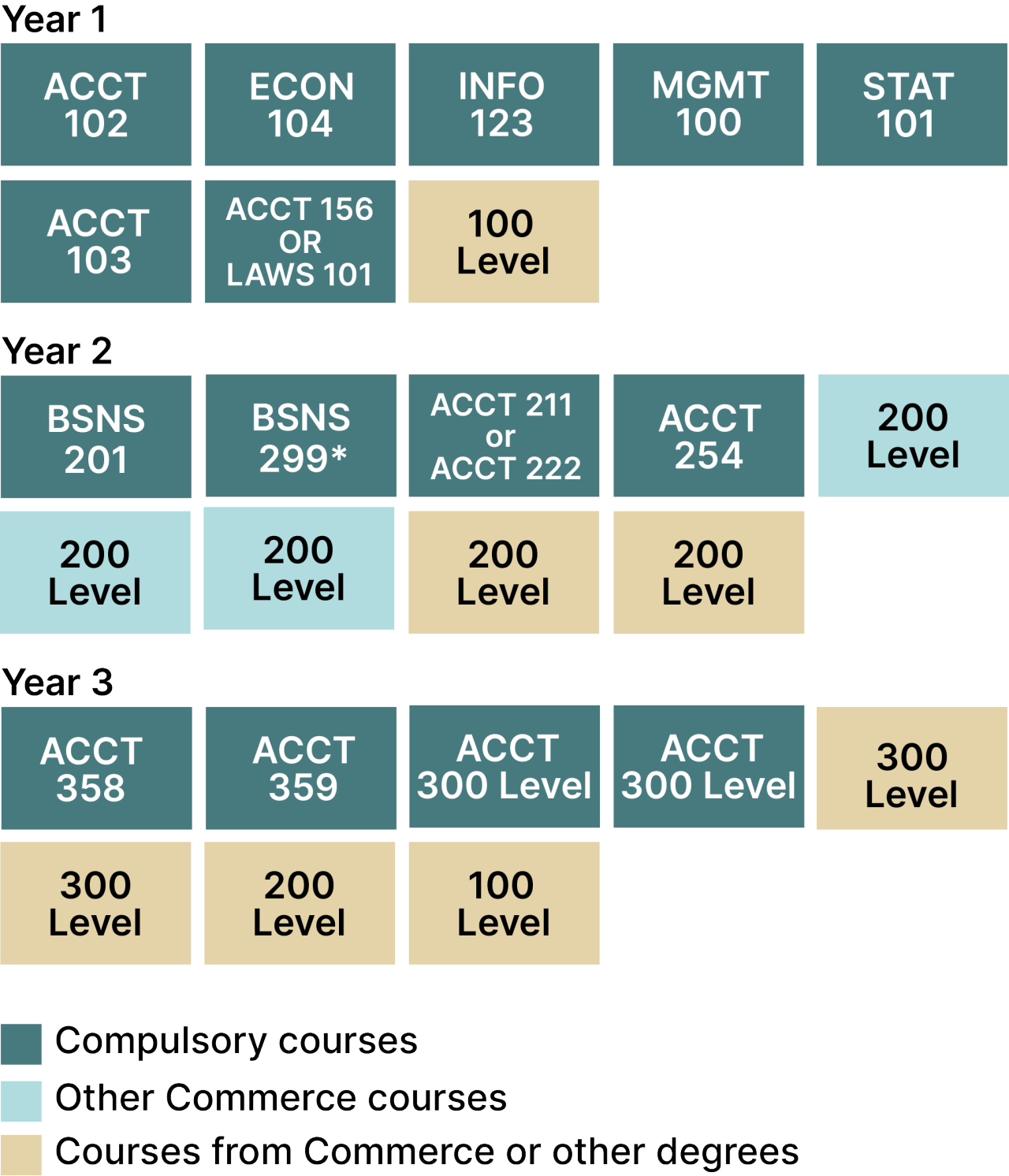

Please note, these are suggested degree plans based on taking a single major. Your individual plan may vary from this based on your combination of major(s) and minor(s). For more information please contact a student advisor.

These degree plans are from 2026 onwards. If you commenced your study prior to 2026 your degree plan may look different to this. If there is any confusion please make an appointment with a student advisor.

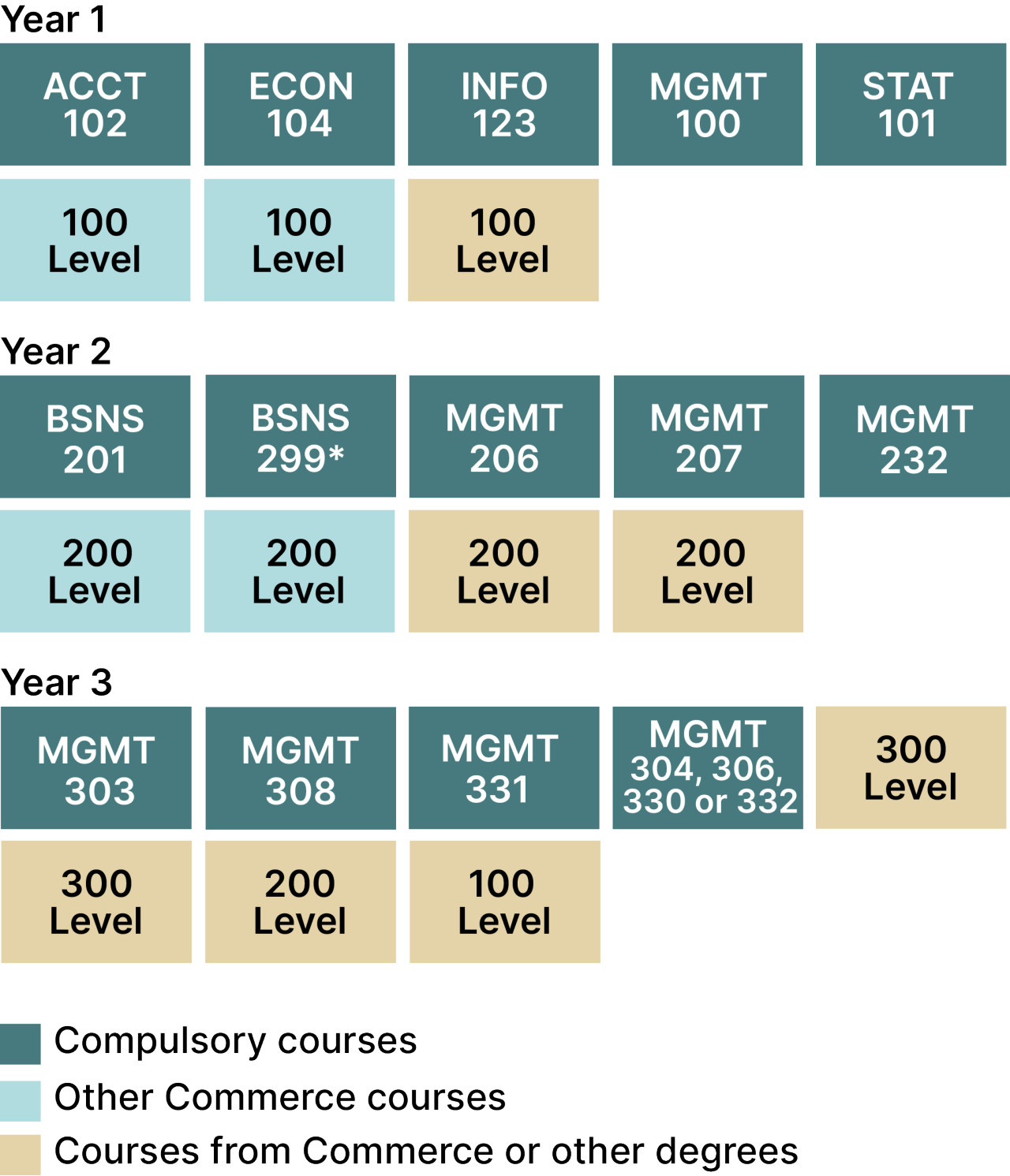

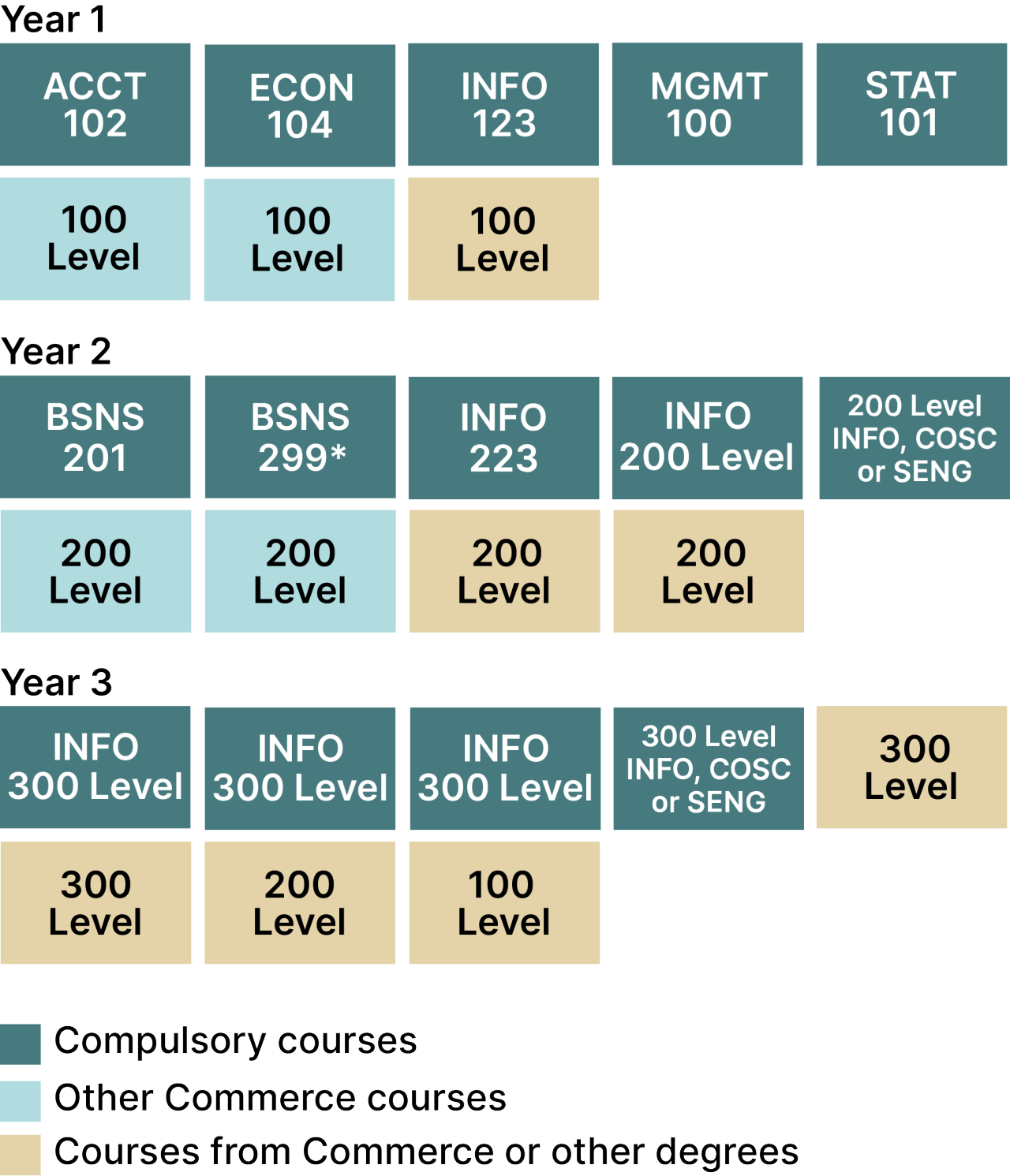

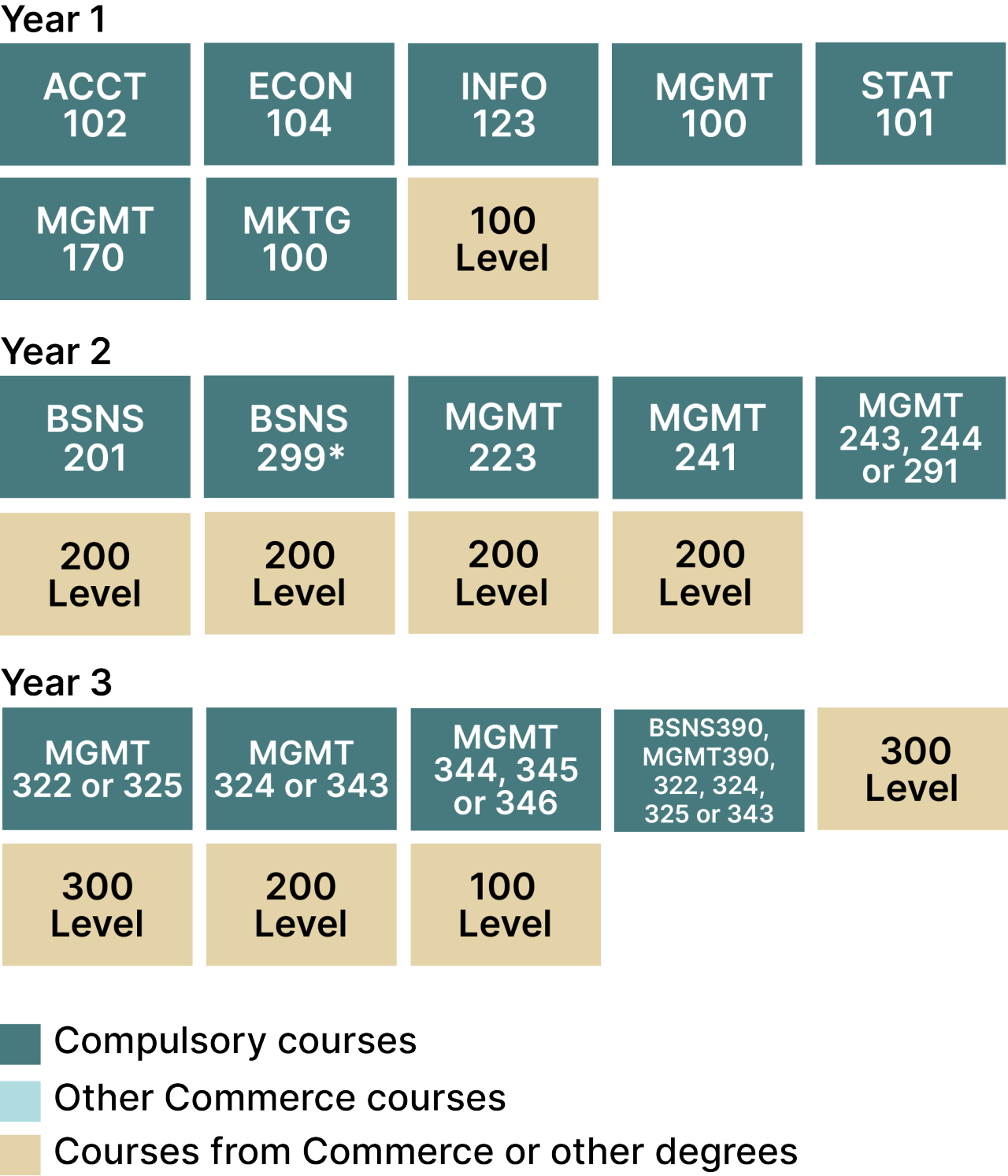

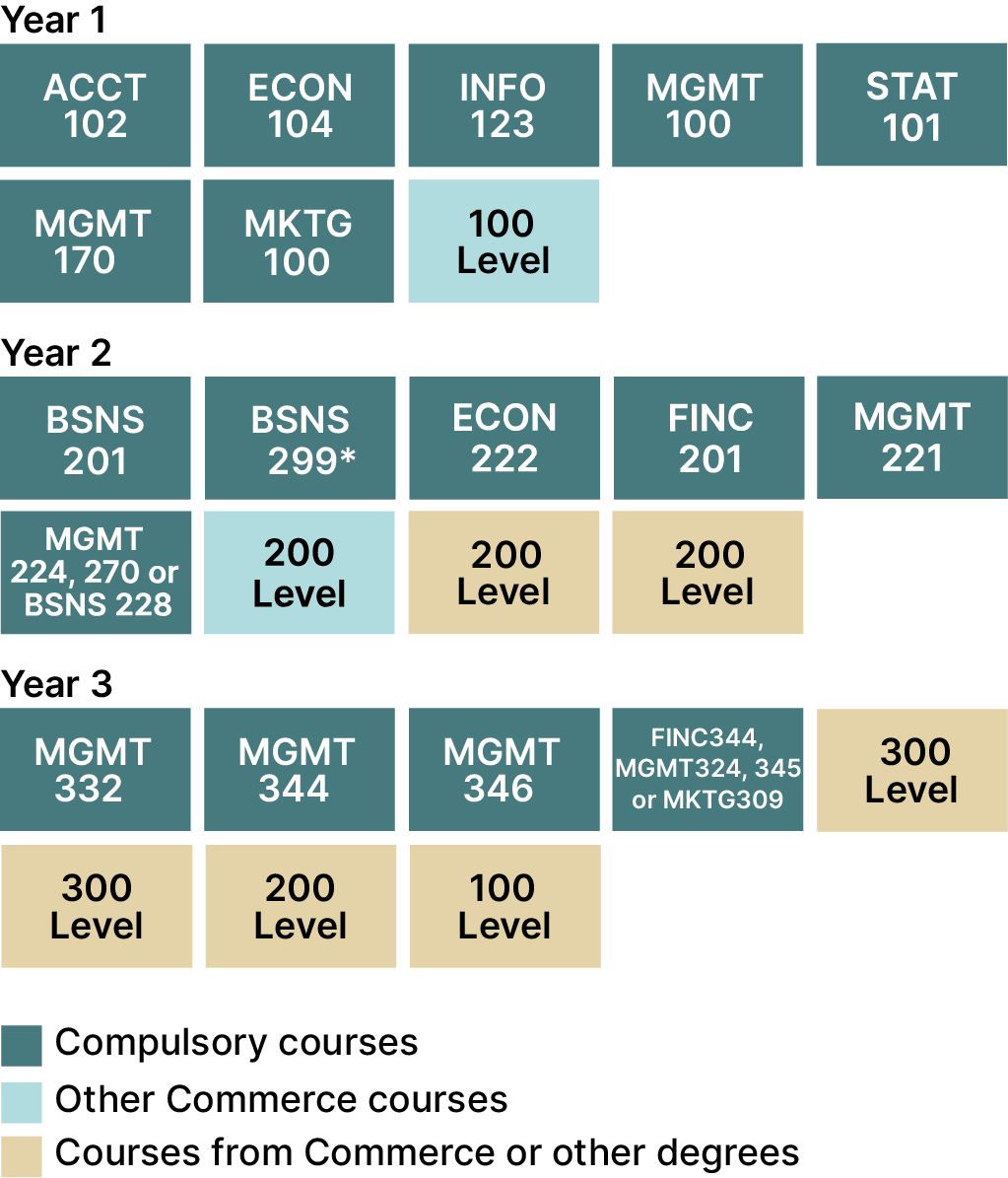

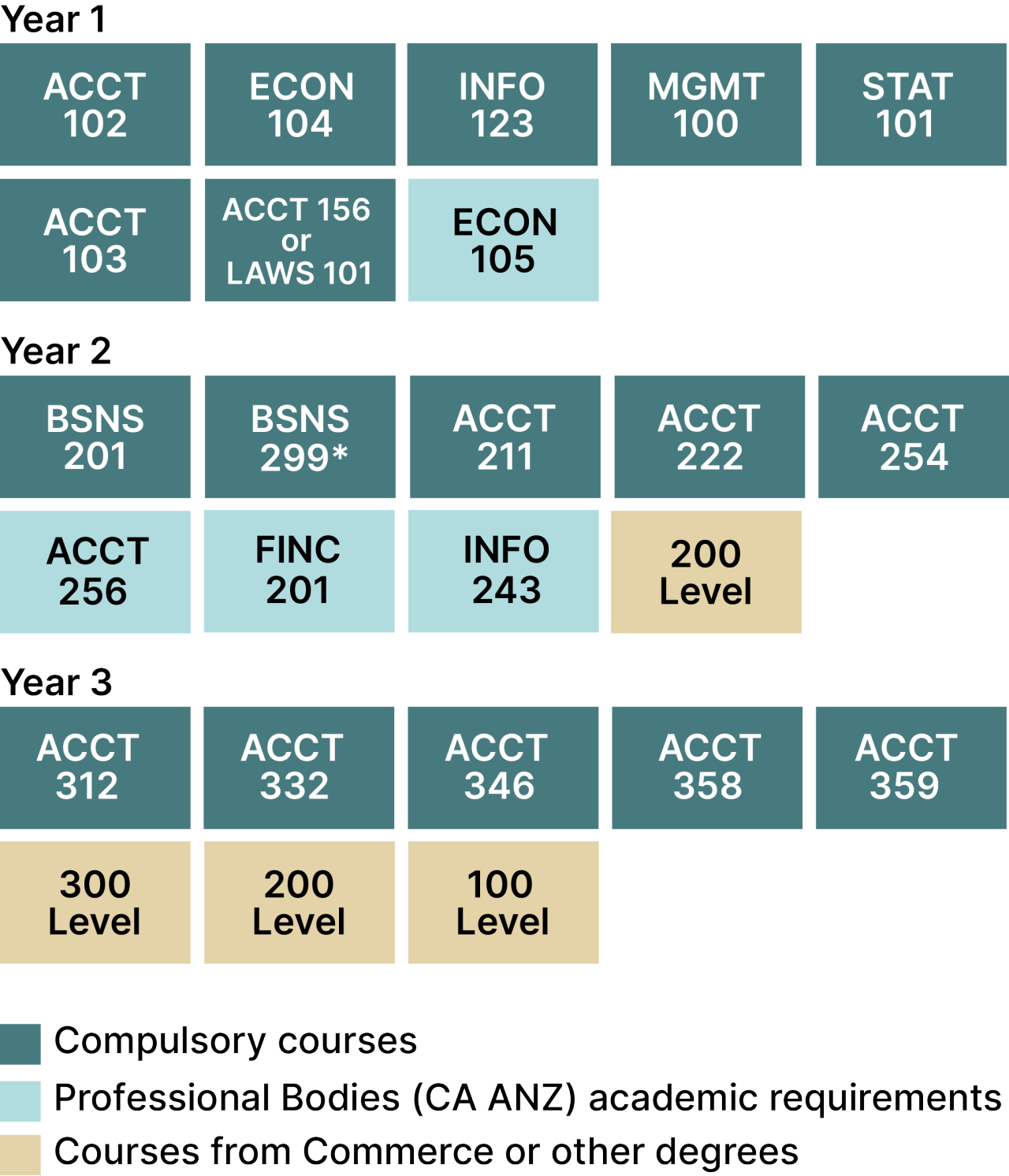

Courses are organised by year to ensure you meet 200 and 300-level course prerequisites. When a course is offered in both semesters you can choose which semester you want to complete it in. To maintain a balanced workload, it is desirable to complete four courses each semester.

Accounting

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

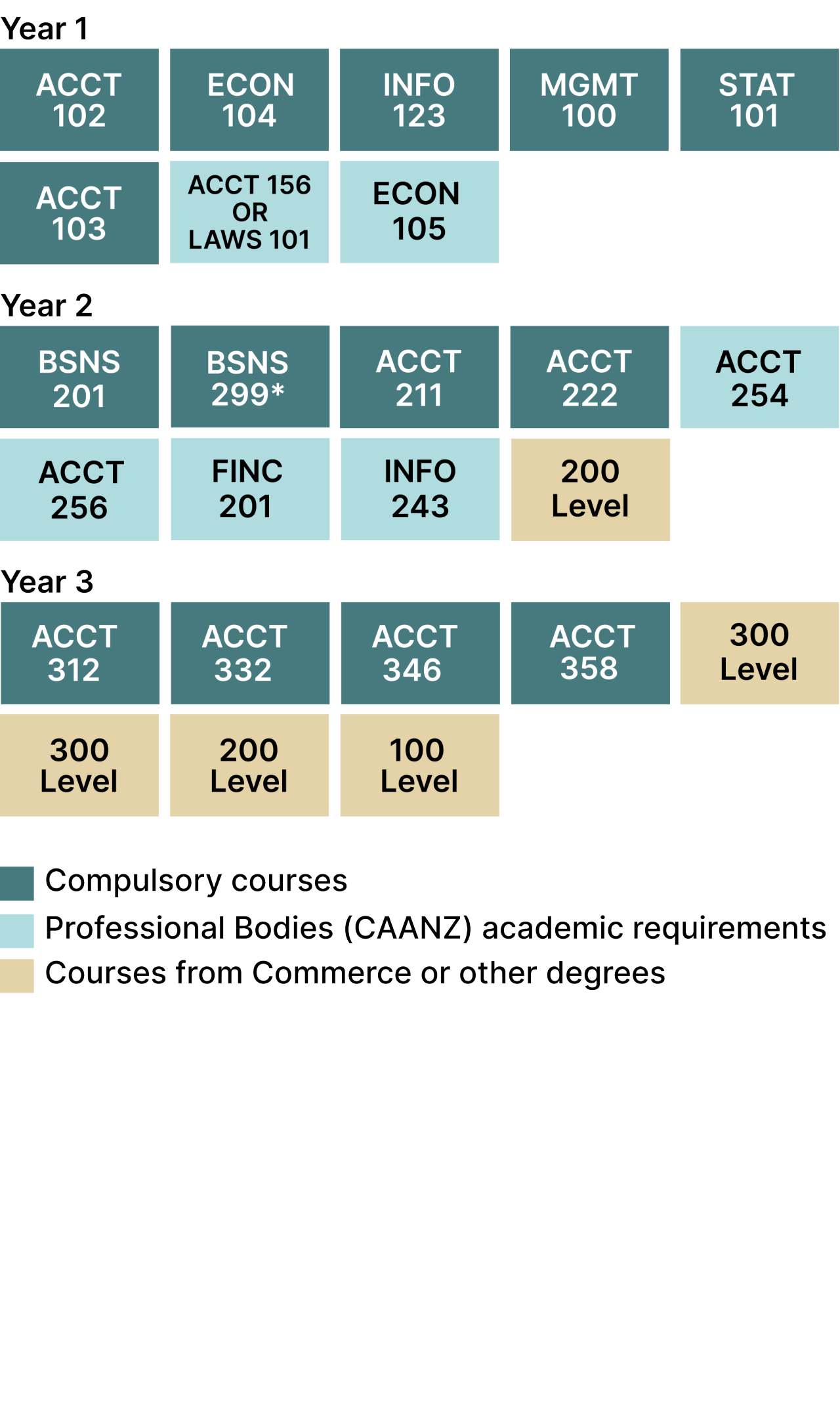

Accounting - Professional Pathway

NOTE:

- ACCT 152 is a 15-point course and LAWS 101 is a 30-point course. If taking LAWS 101 in Year 1, ECON105 can be taken in Year 3 instead.

- For more information on becoming a Chartered Accountant, see the CAANZ website.

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

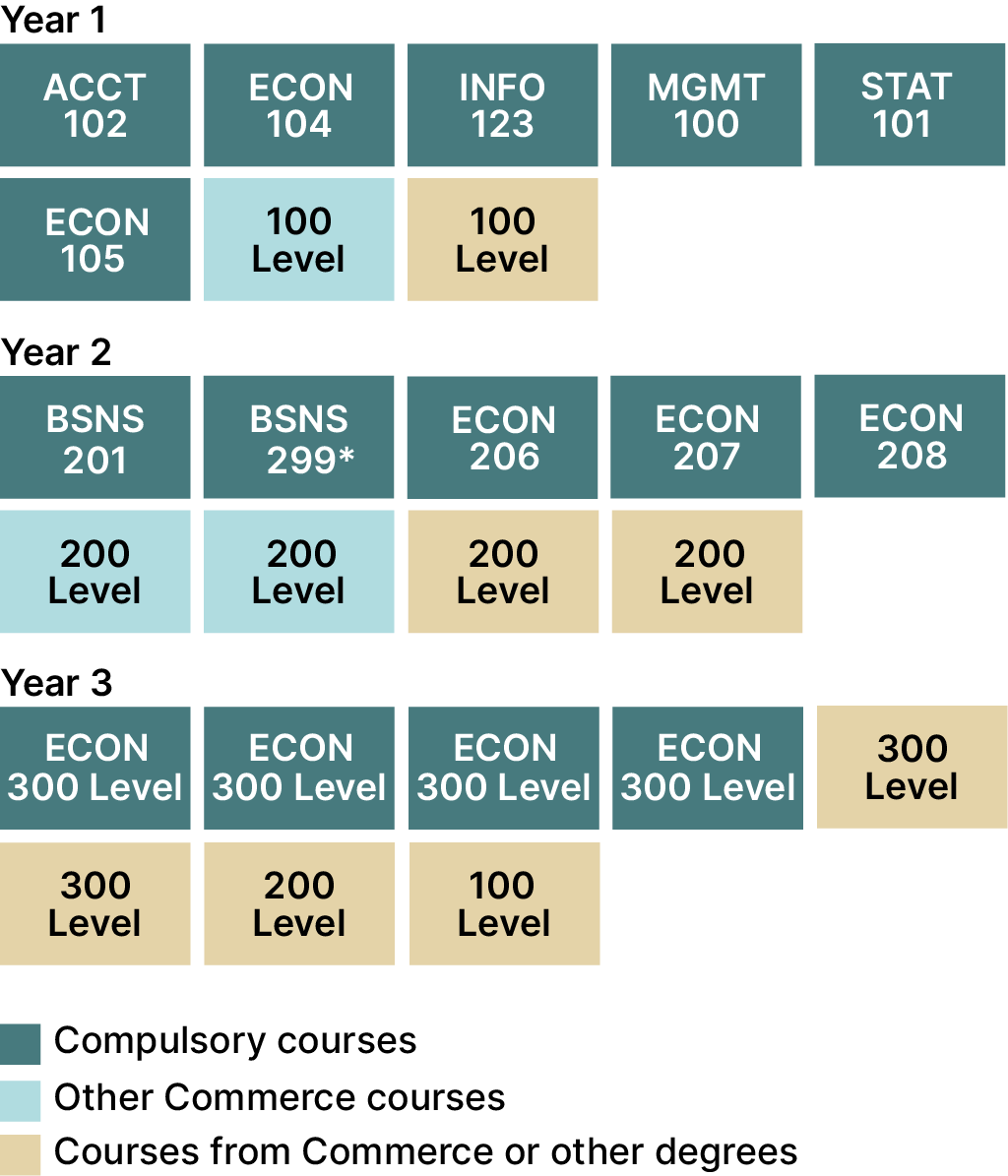

Economics

NOTE:

- If you are interested in postgraduate study in Economics, you should consider taking ECON213 in Year 2 and taking 15 points from ECON321, ECON324, ECON325 or ECON326 in Year 3.

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

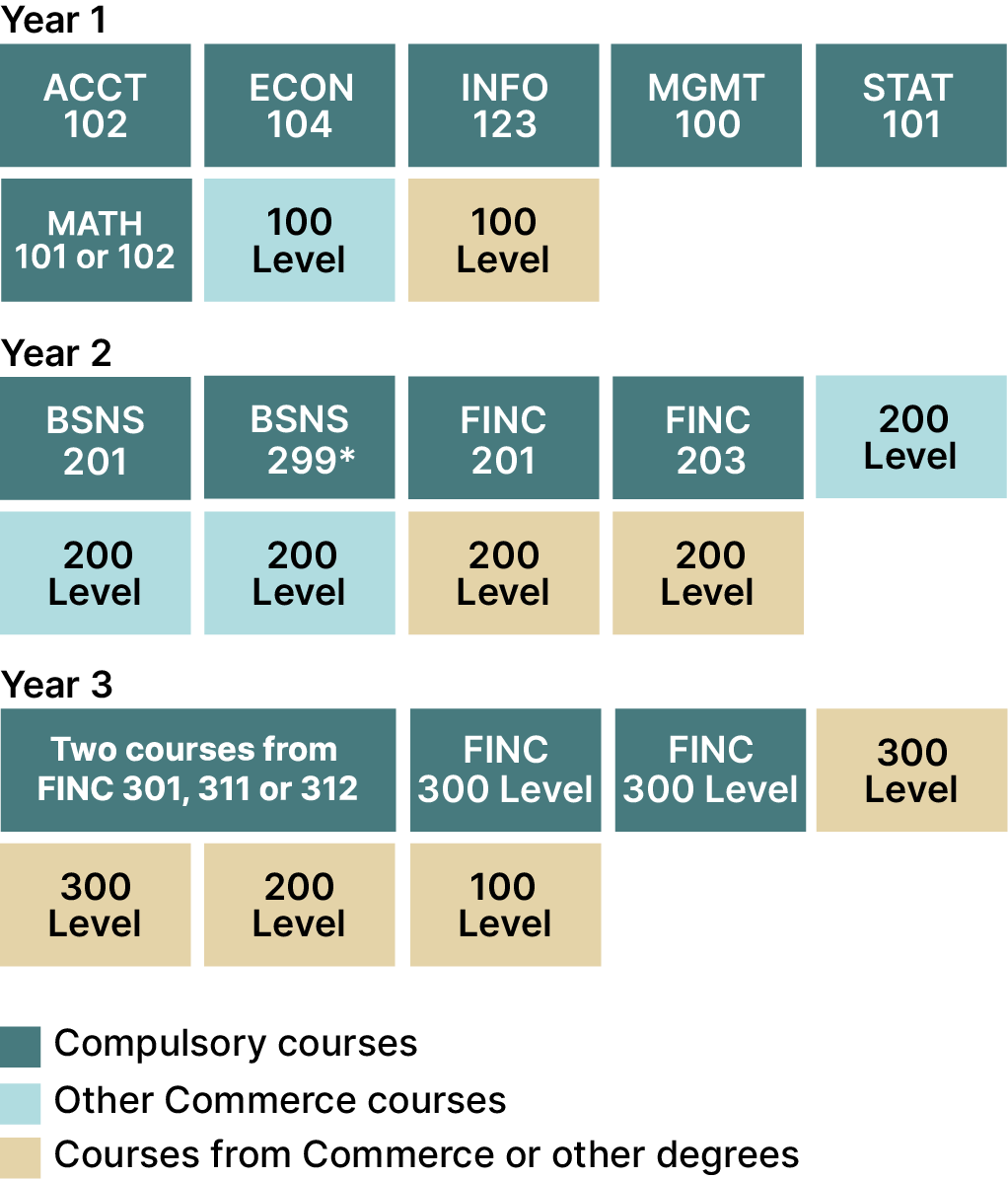

Finance

NOTE:

- If you are interested in postgraduate study in Finance, you should consider taking ECON213 in Year 2 or 3.

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

Human Resource Management

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

Information Systems

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

Innovation and Entrepreneurship

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

International Business

Bachelor of Commerce - International Business (Finance with International Exchange)

Bachelor of Commerce - International Business (Finance with International Exchange)

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

Management

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

Marketing

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

Operations and Supply Chain Management

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

Taxation and Accounting

NOTE:

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.

Taxation and Accounting - Professional Pathway

NOTE:

- ACCT 152 is a 15-point course and LAWS 101 is a 30-point course. If taking LAWS 101 in Year 1, ECON105 can be taken in Year 3 instead.

- For more information on becoming a Chartered Accountant, see the CAANZ website.

- BSNS299 is a 0-point compulsory module and does not contribute to your enrolment workload. It should be taken in your second or third year alongside your other required papers but it is not a full academic course.