UC’s Alumni and Community Weekend from 27-29 October will see an expert panel of economics discuss ‘The New Zealand Economy: Current and Future Issues.’

Wallis says she has achieved a fulfilling and purposeful economics career as a result of taking the right opportunities and not always following a linear career path.

“Nothing comes along exactly at the right time when you imagine it would, but you just have to work with that and sometimes take some risks – that has created the most pivotal moments in my career,” she says.

Wallis, who graduated from Te Whare Wānanga o Waitaha | University of Canterbury in 2008 with a Bachelor of Commerce with Honours, is speaking as part of a panel of economics experts at UC’s upcoming Alumni and Community Weekend. The panel, hosted by the UC Business School on Saturday 28 October, is open to the public and will see Wallis sharing insights on the New Zealand economy with four other high-profile fellow UC Economics graduates.

Wallis says the investing landscape has changed a lot in Aotearoa New Zealand, with Covid having a significantimpact, “through the Covid years interest in shares took off, unfortunately part of that is people being locked out of the property market due to the cost.

“People started looking for alternative ways to grow their wealth. When you think about investing in a share or part of a company instead of the property market, what you’re doing is supporting a business which can grow the economy, so it’s great to see that really taking off in New Zealand.”

However, Wallis says there is still a lot of work to increase knowledge across Aotearoa. “We need to continueimproving financial literacy and raise awareness of the wide range of ways to grow your money.

“You come out of school or university, start earning a bit of cash; the typical path that people follow is home ownership and that’s your financial store of cash for the next 40-50 years. It’s historically the way Kiwis have built wealth, but that isn’t necessarily the best option for everyone.”

“The introduction of KiwiSaver was quite important in changing financial literacy, as the first cab off the rank for many New Zealanders in learning how to grow wealth outside of the property market.”

Wallis says it is exciting to see a growing number of women in finance, “seeing more females coming through the financial world is helping to make a more equitable space. When I was coming through uni, it was still very male dominated as a whole. That is changing now.

“There’s much more of a conscious effort to encourage diversity now. I think about the role I currently do, and a lot of our clients are female – having someone relatable really helps.”

Wallis originally pursued a psychology major alongside her commerce degree but switched to finance in her second year. She says the human element of finance remains one of the most interesting aspects of her job, “the intersection of humans with finance is fascinating, because ultimately what drives the markets is humans making decisions.”

While we should expect AI to play a role in the future of finance and economics, Wallis believes that humans will never fully be replaced.

“I see AI as a tool to work alongside humans. I think of what we do here at Forsyth Barr, we are a business built on relationships. People come to us because they value us as people and that’s not going to be replaced by a computer.”

So, what advice does someone who has been in the industry for 15 years have to share? It comes down to diversification and patience.

“There’s a great Warren Buffet quote that we use frequently; ‘The stock market is a device for transferring money from the impatient to the patient’.

“If you’re investing in shares over the medium-to-long term then they can be a fantastic tool to build your wealth. Having a longer horizon allows you to ride the ups and downs that can come with stock markets. And of course, don’t put all your eggs in one basket, diversification is key.”

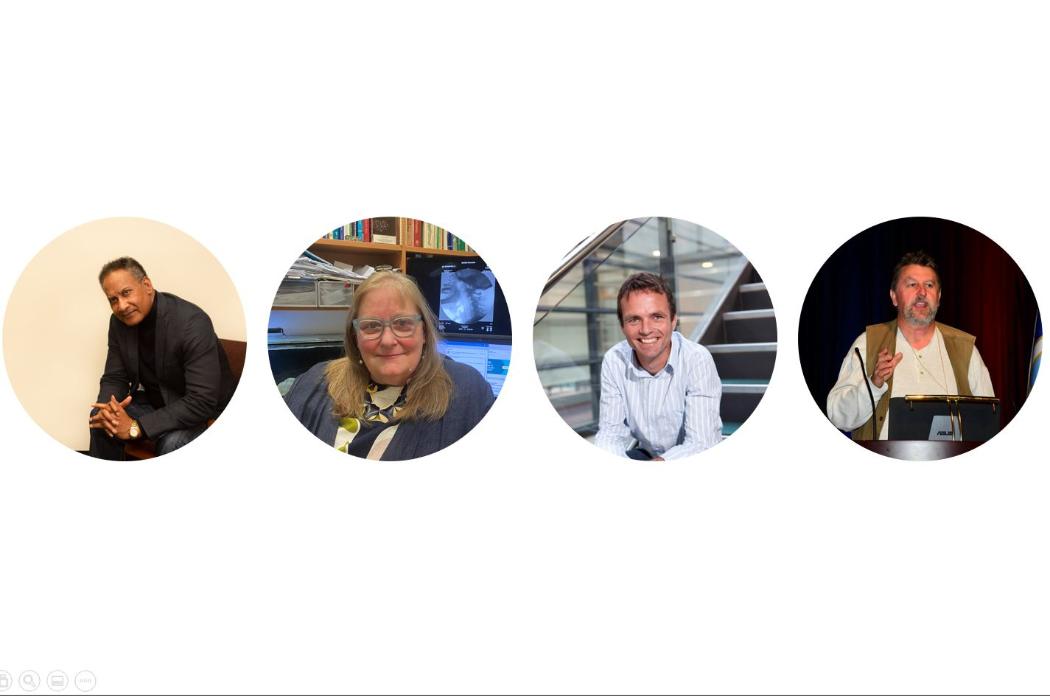

- The panel on Saturday 28 October will see Te Whare Wānanga o Waitaha | University of Canterbury (UC) graduate Zoe Wallis joining a stellar line up of UC Economics graduates including Cameron Bagrie of BagrieEconomics and former Chief Economist of ANZ; Christian Hawkesby, Deputy Governor of RBNZ; John Small, Chair of the Commerce Commission; Nick Tuffley, Chief Economist of ASB.

To register for the panel and see the other Alumni and Community Weekend activities, including a community picnic, click here.

Zoe Wallis is an Investment Strategist at Forsyth Barr Limited. This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice.

.png)